How to Import Goods to South Africa: A Complete Guide

Updated: June 2025

International shopping opens up a world of products to South African consumers and small businesses. However, figuring out how to import to South Africa can be complex due to multiple steps and regulations. Without proper preparation, the import shipping process may lead to unexpected expenses, delays, or compliance headaches.

This complete guide will show you how to import goods into South Africa step by step – covering everything from pre-shipment planning and documentation to choosing a shipping method, clearing customs, and final delivery. Along the way, you’ll find tips to avoid common pitfalls and see how working with a reliable partner like Scott’s Shipping Services (SSS) can save you time, ensure compliance, and make the process much easier.

Step 1: Pre-Shipment Planning and Preparation

Before ordering anything from overseas, make sure your goods can be legally and safely imported. Some items are prohibited or require special permits (e.g. firearms, certain foodstuffs, hazardous materials). If you ship restricted goods without the proper import permit, customs can seize or destroy the shipment and issue fines. Always check South Africa’s official import restrictions in advance or or view our list of commonly restricted items HERE.

Also consider any importer regulations. The South African Revenue Service (SARS) lets individuals bring in a limited number of shipments (up to a total value of R150,000) before requiring you to register as an importer. If you plan to import frequently or for a business, you’d normally need to get a SARS importer’s code. By using SSS as your Importer of Record, you can import as often as needed without having to obtain your own importer registration. This saves the hassle of extra bureaucracy and paperwork.

Next, budget for all costs upfront so you aren’t caught off guard. It’s easy to focus on a product’s price and international shipping while forgetting import duties, VAT, and other fees. Imported goods can incur customs duties (which varies by product category) plus a 15% VAT on 110% of the item’s value including the duty. Combined import taxes can range widely – roughly 15% of the item’s value if there’s no duty, up to 40-50% or more for high-duty items. You should also factor in customs clearance charges or courier handling fees on arrival. As a rule of thumb, add about 20–30% on top of the purchase price to estimate your full landed cost. Even better, use a tool like SSS’s online Quick Estimate calculator to get an exact quote (item price, international shipping, duty, VAT) before you order. Knowing the true total cost in advance will help you decide if importing is financially sensible and prevent nasty surprises later.

Finally, choose trustworthy suppliers and shipping arrangements. Buy from reputable international retailers or platforms and confirm the seller can ship to South Africa (or at least to an international package forwarding address). Ensure items are packed securely — poor packaging or unreliable shipping can lead to damage or loss in transit. If you aren’t sure how to purchase from an overseas store, SSS will handle the buying for you when you provide them a product link. By taking these preparatory steps – verifying item eligibility, securing any needed permits, and budgeting properly – you’re laying a solid foundation for a smooth import. A service like SSS will assist from the start by checking for restrictions, advising on permits, and correctly classifying your goods for customs, helping you avoid common pitfalls that cause delays or extra costs down the line.

Step 2: Ensuring Proper Documentation

Accurate paperwork is the lifeblood of hassle-free customs clearance. Missing or incorrect documents are one of the most common reasons shipments get delayed or hit with fines in customs. Before your package ships, make sure you have all the required documents prepared:

Commercial Invoice:

Provided by the seller, it lists the buyer and seller info, describes the goods, quantities, and the true value. Customs uses this to assess duties, so it must be accurate (no zero-value “gift” invoices).

Packing List:

An itemized list of the shipment’s contents including descriptions, weights, and dimensions. It should match the invoice and helps customs verify the cargo.

Transport Document:

Proof of shipment and tracking details. For air shipments (courier or cargo) this is the Air Waybill; for sea freight, it’s the Bill of Lading.

Certificates/Permits:

Any special paperwork needed for your items (e.g. an import permit for restricted goods, or a certificate of origin if you’re claiming a lower duty rate under a trade agreement). Secure these before shipping to avoid customs holds.

Double-check that all information is consistent across documents. Even a minor discrepancy (say, a value on the invoice not matching the packing list) can raise red flags and lead to inspections. If you’re handling the shipment yourself without a freight forwarder or clearing agent, note that you’ll also need to complete a SARS import declaration form (the SAD 500) when the goods arrive, and any mistakes on that form can cause delays.

This is where using a professional shipping forwarder or customs clearance company like Scott’s Shipping Services brings peace of mind. SSS takes care of all the paperwork for you: they prepare or verify the commercial invoice and packing list, file the necessary customs declarations, and ensure all duties and VAT are properly accounted for upfront. Essentially, SSS handles all the documentation and payments behind the scenes. From your perspective, the process becomes simple — you receive one final tax invoice in South African Rands covering all costs, while SSS manages the complex forms and communications with customs. This not only saves you from tedious paperwork, but also greatly reduces the chance of errors that could delay your shipment.

Step 3: Choosing the Right Shipping Method

Your shipping method significantly impacts transit time, cost, and how your shipment is handled when it reaches South Africa. You have a few international shipping options, each with pros and cons:

Express Courier (Door-to-Door):

International couriers to South Africa (like DHL, FedEx or UPS) offer the fastest and most convenient delivery for small to medium parcels, often as quick as 3– 10 business days. They handle customs clearance as part of their service, billing you for any duties and VAT (plus a small admin fee) on delivery. Costs can be high for very heavy shipments, but for most online shopping orders, express courier provides the best balance of speed and reliability. (With SSS, all import fees and clearance charges are quoted upfront, so you won’t get surprise bills.)

Air Freight (Cargo):

Best for shipments too large or heavy for courier, or for certain restricted items couriers won’t carry. Air freight is still relatively fast (around 3–7 days transit), but you will need a freight forwarder or agent in South Africa to clear the goods at the airport. Costs are calculated by weight/volume, and there may be handling or storage fees on arrival. Businesses use air freight for urgent, big shipments or specialized goods. (SSS will arrange dedicated air freight if needed, handling the whole process for oversized or special cargo with all costs included upfront.)

Sea Freight:

An economical choice for very large or bulk orders that aren’t time-sensitive. Sea shipping costs far less per kilogram than air, but transit takes much longer (often 6–8 weeks or more). It also involves additional complexity: you may need a shipping agent to handle port customs clearance, and storage fees can accrue if there are delays. Sea freight makes sense for wholesale imports or large equipment, but not for typical e-commerce purchases due to the long wait. (SSS will assist with sea freight on request, though most individual importers stick to air.)

Postal Service:

Some sellers offer international post or EMS. This method is extremely slow and unreliable for South Africa. Parcels might take weeks or even months to arrive, and tracking is limited. If customs duties apply, you’ll get a notice to pay at a post office or customs depot before you can collect your package. There’s also a higher risk of lost packages or surprise storage fees if you don’t pick it up in time. Because of these issues, postal mail is best avoided for important shipments. (Notably, SSS never uses postal mail for its customers due to these problems.)

When deciding on a shipping method, consider your package’s size, weight, value, and how urgently you need it. In most cases, an express courier is the go-to for importing goods to South Africa because it’s fast and truly door-to-door. Reserve air freight for shipments that are too large or restricted for couriers, and use sea freight only for massive shipments where low cost matters more than speed. It’s usually wise to steer clear of postal mail for valuable or time-sensitive items to avoid long delays. If you’re unsure, consult an expert. A specialized shipping company like SSS can advise you on the best option for your needs. In fact, SSS consolidates individual packages from abroad into bulk shipments sent via expedited air courier. For example, your overseas orders are delivered first to an SSS international warehouse, combined with other customers’ packages into a larger shipment, and then flown to South Africa. Thanks to this consolidation, you benefit from cheaper bulk shipping rates and a quicker delivery — without having to manage any logistics yourself or worry about choosing the wrong method.

Step 4: Customs Clearance in South Africa

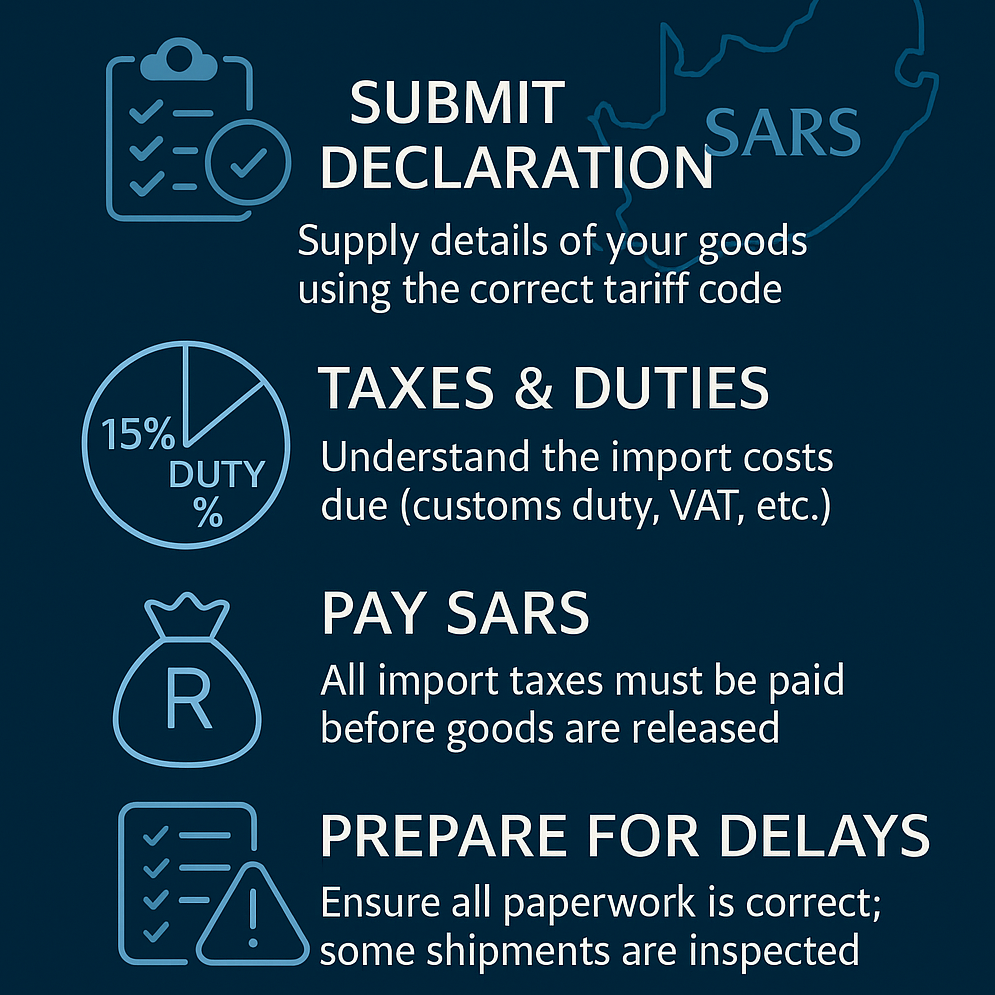

When your shipment arrives, a customs declaration (Bill of Entry) must be submitted to SARS with details about the goods. A crucial part of this is correctly classifying your items under the proper HS code (tariff code), which determines the import duty rate. With thousands of codes, classification can be tricky – a wrong code might mean you pay the wrong duty or face penalties for misdeclaration. Always use the correct tariff code (consult SARS’s tariff database or an expert if unsure). (SSS provides expert tariff classification as part of its service to prevent costly errors.)

Next, be aware of the import taxes involved. South Africa charges customs duties on many goods (the exact rate depends on the product and can range from 0% for some items up to 45%+ for others). On top of duties, a 15% VAT is applied on the 110% of the item’s value plus any duty. In practice, total import taxes might be as low as ~15% of the value (for duty-free items) or well over 50% for items with high duties.

Understanding these potential charges in advance helps you budget for the full landed cost.

To actually clear customs, all import taxes (duty + VAT) must be paid. With courier shipments, the courier company usually advances these charges to speed up clearance and then bills you (adding a small clearance fee) before they deliver the package. If you’re importing via freight and handling it yourself, you must pay SARS directly before the goods are released. Customs delays can occur if paperwork is missing or incorrect, if SARS questions your declared values, or if a required permit wasn’t provided. Sometimes SARS will select a shipment for a random physical inspection, which can add a few days and possibly an inspection fee. The best way to avoid delays is strict compliance: ensure all your documentation is in order, declare honest values, and have any needed permits secured ahead of time so SARS has no reason to hold your shipment.

Here again, a professional service can be invaluable. Scott’s Shipping Services manages the entire customs clearance process on your behalf. They prepare and submit all the declarations with the proper codes and documentation, ensuring compliance from the start. Importantly, SSS pre-pays all duties and VAT for you and includes those costs in your upfront quote. By the time your shipment arrives, the taxes are already settled and the paperwork is in order, allowing your package to clear customs almost immediately. SSS often begins clearance procedures while your goods are still in transit, so there’s little to no waiting once they land. Another advantage is that SSS acts as the Importer of Record for your shipment, meaning you don’t need to have a personal SARS importer account or interact with customs directly. In short, SSS handles the hard work with SARS behind the scenes – calculating taxes, filing forms, and resolving any issues – so you get a quick, hassle-free clearance without headaches or surprise charges.

Step 5: Final Delivery to Your Door

Once your shipment has cleared customs, the last step is getting it into your hands. How this happens depends on the shipping method used:

Courier shipments:

If you shipped by courier without prepaying the import taxes, be prepared to pay the courier for duties and VAT (plus their small processing fee) before the package is handed over. If everything was prepaid (for example, via SSS, where duties are included upfront), the courier will deliver to you without any payment needed on delivery. Prepaid shipments also tend to arrive very quickly – often by the next business day in major cities once customs is cleared (with an extra day or two for remote areas).

Freight shipments:

If your goods came in by air freight or sea freight, you’ll need to arrange the final leg of delivery. Usually this means hiring a transport company or local courier to collect the goods from the airport or seaport warehouse after clearance and bring them to you (unless you plan to pick up in person). Be mindful of any handling or storage fees at the cargo depot if pickup is delayed.

Postal shipments:

For packages sent via postal mail, you’ll receive a notice instructing you to go to a specific post office or customs depot. You must pay any duties there and then collect your package yourself. This process is slow and inconvenient, and if you wait too long to pick it up, the postal service may start charging storage fees.

Always be aware of any final delivery charges. For example, couriers may add an “out-of-area” surcharge for remote addresses, and if customs performed an inspection on your parcel, they might levy a small inspection fee. Many first-time importers get caught off guard by these last-minute costs or extra steps. To avoid surprises, check what your shipping service covers for final delivery and aim for a door-to-door arrangement that includes everything.

With Scott’s Shipping Services, final delivery is truly hassle-free. SSS provides true door-to-door service with no hidden charges at the end. All local delivery fees and handling costs (even any standard remote-area surcharges) are built into their upfront quote. Once your parcel clears customs under SSS’s management, it’s handed to a trusted local courier and brought straight to your address – you won’t need to visit customs offices or depots to retrieve it. You’ll also receive tracking updates so you know exactly when to expect delivery. Even if there’s a rare delay (say, a random customs exam), SSS handles the follow-up and keeps you informed, so you’re never left in the dark. Thanks to pre-clearance and express handling, most international orders shipped via SSS reach your doorstep in around 10–21 days total, much faster than traditional methods. For a small business waiting on stock or a consumer excited about a purchase, that kind of speed and convenience is a major advantage.

Tips to Avoid Delays and Hidden Costs

Importing can be complex, but following a few best practices will help you steer clear of common pitfalls:

Do Your Homework on Regulations:

Verify that your product is allowed and check if it needs special permits before you buy. Importing prohibited or restricted items without the proper paperwork can lead to confiscation and fines. When in doubt, consult SARS guidelines or ask your shipping partner about any restrictions.

Calculate the Full Landed Cost Upfront:

Don’t underestimate the impact of duties, VAT, and fees. Before purchasing, figure out what the item will cost delivered to your door, including all import taxes. Most goods will incur 15% VAT and potentially duties anywhere from ~5% up to 30% or more depending on the category. Use online calculators or ask your logistics provider for an estimate. Budgeting for these charges in advance prevents nasty surprises and cash flow issues.

Choose the Right Shipping Method:

Match your shipping mode to your needs, balancing speed vs. cost. For most, an express courier is the safest bet for hassle-free, fast international shipping to South Africa, whereas very large equipment might justify air or sea freight. Avoid ultra-slow options like untracked postal mail for valuable items. If unsure, seek advice from an expert service (like SSS) to recommend the optimal method.

Ensure Accurate Documentation:

Mistakes in paperwork (wrong values, incorrect HS codes, missing forms) are a leading cause of customs delays and penalties. Fill out all documents carefully or let a professional handle it. Providing complete and truthful information will streamline your customs clearance.

Plan for Final Delivery Costs (or Use All-Inclusive Services):

Remember that beyond overseas shipping and import duties, there can be local delivery, handling, or storage fees at the end. Couriers might charge admin or clearance fees; freight shipments can accrue warehouse charges if you delay pickup. To avoid hidden fees, either budget extra for these or use a door to door service that includes all final delivery costs in one price (SSS’s quotes, for example, cover delivery to your door with no surprise add-ons).

By following these tips – essentially, thorough planning, smart choices, and not cutting corners on compliance – you’ll significantly reduce the risk of delays, surprise costs, or other importing frustrations.

Conclusion: Streamline Your Imports for Success

Importing into South Africa doesn’t have to be intimidating. By understanding the process and planning each step – from initial research and choosing the right shipping mode to handling customs and delivery – you can import goods with minimal hassle and expense. The key is to be proactive: do your research, get your paperwork in order, and budget for all eventualities. And remember, you don’t have to navigate this journey alone.

Partnering with a reliable freight forwarder can save you time, ensure compliance, and provide clarity at every step. An end-to-end package forwarding solution like Scott’s Shipping Services is designed to help consumers and small businesses import with ease. SSS offers transparent pricing, expert customs handling, and true door-to-door convenience, turning what could be a complicated task into a smooth experience.

Ready to import with confidence? With careful planning – or the assistance of a trusted logistics partner – international shopping can feel as seamless as buying locally. Avoid the pitfalls, embrace the opportunities, and let experienced professionals like Scott’s Shipping Services help you every step of the way. Soon you’ll be receiving your overseas purchases in South Africa quickly, cost-effectively, and hassle-free. Happy shipping!

If you’re planning your next import, don’t leave it to chance. Scott’s Shipping Services is here to make the process smooth, cost-effective, and fully compliant. Get your quick estimate today using our online calculator, or contact us for expert advice on your shipment.

About the Author

Written by Scott Kirby, Director of Scott’s Shipping Services.

Scott is the founder and director of Scott’s Shipping Services, a trusted name in international shipping and customs clearance in South Africa. With over a decade of experience helping hundreds of individuals and businesses import goods safely and efficiently, Scott combines technical expertise with practical know-how. His team has managed over 5000 successful shipments globally, earning a reputation for reliability, transparency, and hassle-free service.